Blog

- Details

- Hits: 1335

It may seem unusual to some to sell a house over the festive period, however, the property market is very much still active at this time of the year. The number of post-Christmas home buyers to browse for properties on Rightmove increases every year, with visits on Boxing Day last year 54% higher than the previous year. People have more free time and motivation to make a change in time for the New Year, so it can be a great time to buy and sell.

With this in mind, here are our top tips for buying and selling over Christmas.

An online presence is vital

If you are selling your home, it needs to be listed and visible on all the major property portals (like Rightmove) over Christmas. People will tend to have more free time and will start to browse properties online over the festive season.

We believe that sellers need to take advantage of this busy time. Once Christmas Day and Boxing Day are over, people are looking towards a New Year move. Don’t miss out the opportunity of hitting the market when it’s hot!

Rightmove say that Boxing Day is their busiest all year. But why is this period so busy? One reason could be due to the new phones and tablets that people are often gifted at Christmas. It is also one of the few holidays that the family will be all together and most likely at home. This means that any discussions about viewings and a move can be had with all the decision makers present. With the upcoming New Year, there's no better fresh start than a new home.

Winter weather

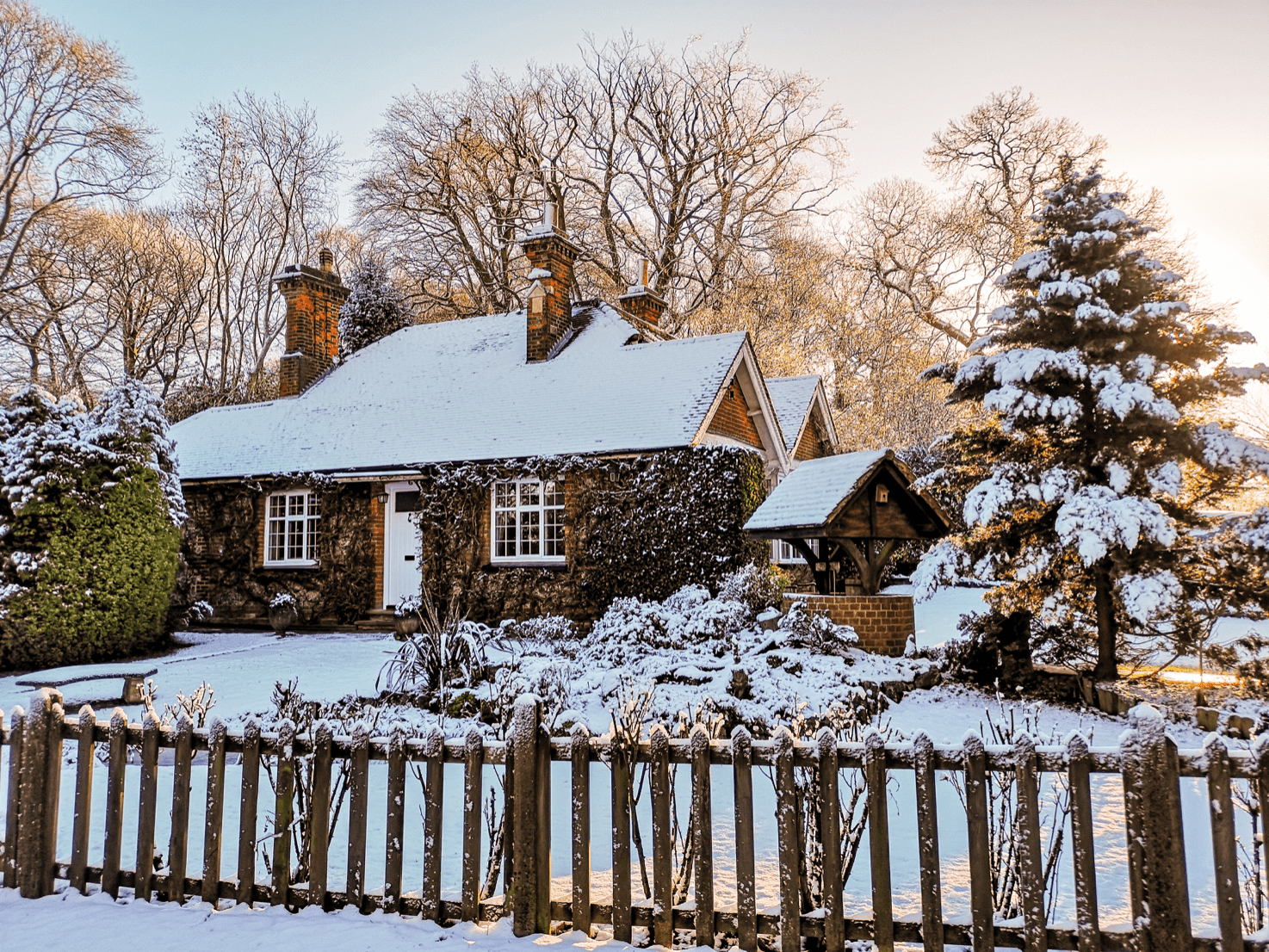

Spring is a popular time to buy and sell, but winter has its benefits, too. Sometimes stepping into a bright, warm, cosy home on a bitterly cold day or drizzly evening can have just as positive an effect as viewing a property on a warm summer day.

Tip: Try to arrange viewings in the daylight. If you arrange a viewing later in the day, you won’t get the true experience of the property, especially if there is outdoor space. It is important to view them before the night draws in.

Ready for the New Year rush

In the New Year, there will be a rush of people looking to buy and sell. Why not beat the rush by instructing an Estate Agent or getting to know the market in December? Many sellers hold off until January and miss out on the busy online searching period. Additionally, because there are typically less properties on the market during the holidays, you may benefit from lower competition levels.

Tip: Don’t underestimate how long it takes to get your home on the market!

Given the time it takes for us to prepare the marketing material for a property, including taking photos, preparing floorplans and commissioning an Energy Performance Certificate (EPC), it is advisable for sellers to start the process now to get ahead of the competition and take advantage of these peak periods.

Don’t wait until spring

It is not essential to wait until Spring to sell. Most sellers wait until spring and then there is more supply and more competition, whereas over the Christmas season, there is less supply but still high demand. By selling your home over the festive period, you may be more likely to achieve a better selling price than you would trying to sell against the flurry of stock in the spring market.

Book a valuation today by calling 01934 815 053 or emailing This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Hits: 1293

Property Expert David Plaister states that the number of mortgage products on the market has increased for the first time since June, as lenders look to meet growing demand, but average borrowing rates have increased further, the latest research from Moneyfacts shows.

There are currently 2,404 mortgage products available on the market, up from 2,259 a month earlier.

According to Moneyfacts, the strongest growth in mortgage products over the past month has been seen in the 75% and 80% loan-to-value (LTV) sectors where product numbers have increased by 43 and 49 respectively.

There has been a significant increase in demand for mortgages, as buyers rush to acquire property before stamp duty goes back to its normal rate.

The latest data and analysis from NAEA Propertymark shows that in September the number of prospective buyers registered per estate agent hit a 16-year high.

Eleanor Williams, finance expert at Moneyfacts, said: “Some positive news for those would-be borrowers comes from our latest data, which shows that at 2,404, the number of available mortgage products has risen for the first month since June 2020, following the re-opening of the property market after the first UK lockdown, when 2,810 deals were on offer.”

She added: “It is notable that 63% of the 145 additional products made available this month are offered in the 75% and 80% LTV sectors, where product numbers increased by 43 and 49 respectively.

“Indeed, availability increased across all the LTV tiers this month, with the exception of the limited 95% and 100% tiers where there was no change, and the smallest fluctuation was seen in the next highest LTV bracket at 90%. This could be indicative of the fact that lenders are focusing their offerings towards traditionally lower-risk borrowers with a larger equity or deposit.”

According to the research, there are less than half the number of products available to consumers now than were on offer 12 months ago, while borrowing rates are rising.

David goes on to say this means that borrowers with a 15% deposit or value in their property will be facing rates that are 0.65% and 0.45% higher than this time last year and is without doubt reflective of how uncertain the economic outlook remains.

- Details

- Hits: 1184

Property Expert David Plaister says that the housing industry should prepare for some potential changes after Michael Gove was promoted to housing secretary, replacing Robert Jenrick in the government reshuffle.

Mr Gove, who has left his role as chancellor of the Duchy of Lancaster to replace Jenrick, “takes on cross-government responsibility for levelling up”. He also “retains ministerial responsibility for the Union and elections, as the governments housing carousel continues to evolve as yet another one ‘bites the dust’ and it of course remains to be seen if there will be additional casualties further down-stream.

“Michael Gove is known as a Whitehall ‘big hitter’ with a reputation for rocking the boat so we may well see some changes and therefore expect to see more initiatives focussed on fuelling buyer demand to keep house prices buoyant and very little in terms of actually addressing the need for more housing or indeed changing the conveyancing process to a more fluid and transparent one.

David went on to say “In recent times, those charged with addressing the current housing crisis have lasted less time in their post than it takes to sell a house. No wonder the sector has been riddled with scandal and an inability to reach housing targets.”

High on Gove’s to-do list will be the pressing need to address the growing housing supply crisis in both the sales and rental market.

Ben Beadle, chief executive of the National Residential Landlords Association, said “We welcome Michael Gove to his new position and look forward to working with him to ensure the rental market works for responsible landlords and tenants alike.

“Key to this will be addressing the supply crisis in the sector by developing pro-growth policies that recognise the vital contribution it makes to housing millions of people across the country.”

Sam Le Pard co-founder of LEXI Finance, commented: “At a time when we still face a shortage of housing, material price inflation and supply chain issues, the new housing secretary will need to rapidly get to grips with their brief if they are to enable SME developers to play a key role in tackling the housing crisis.

Marc Vlessing, chief executive officer of Pocket Living, believes that the UK’s housing market is “dysfunctional and real change is needed”.

He said: “The new secretary of state has inherited his brief at a critical juncture, with a series of radical reforms currently held in stasis due to significant resistance from within a governing party unconvinced by the manner and need for change. Yet this is not the time to be timid or seek to reverse away from the fundamental issue the reforms seek to address.”

Nick Sanderson, CEO, Audley Group, concurred: “Top of Michael Gove’s agenda has to be aligning the housing and health departments. Under too many of the past leaders, these departments have operated in a fragmented way, ignoring holistic solutions which have the potential to tackle both the housing and social care crises.

David commented further by saying “The need for change is paramount but more importantly must be meaningful, bringing together housing, health and social care under one banner, marking a radical shift towards solving issues at their roots.

“Building more specialist housing would have far reaching implications: freeing up existing family homes, taking pressure off the NHS and social care systems, and importantly giving older people suitable and aspirational housing that adapts to their changing needs. For me the greatest disappointment would be seeing more of what we have come to expect from the housing department. A focus on first time buyers that ignores other vitally important parts of the housing market.”

- Details

- Hits: 1052

Property Expert David Plaister reports that following public consultation earlier this year, draft legislation for a new residential property developer tax (RPDT) has been published by HM Treasury.

The RPDT, which is to be included in the Finance Bill 2022, is to be payable from 1 April 2022 by residential property developers on their UK residential property development profits that exceed an unspecified allowance, with the final design of the tax – including tax rate – to be announced at the Autumn 2021 Budget.

The government first proposed the residential property developer tax in an effort to respond to growing concerns over the costs for cladding repairs, and the potential burden on leaseholders, and details have finally been set out in draft legislation published as part of a technical public consultation earlier this week.

It is understood a final policy decision is yet to be made on whether it will apply to build-to-rent developers.

There is a chance to comment on the details in the draft legislation up to 15 October and the government has produced explanatory notes.

As part of the Autumn Budget on 27 October, the chancellor Rishi Sunak will set out the final details, including the rate of tax and the specific allowances, and this is to be included in the 2021-2022 Finance Bill.